Investment Policy

Investment Policy of the Big Spring Area Community Foundation

The Investment Policy was adopted by the Trustees of the Big Spring Area Community Foundation (the "Board") to direct the prudent investment of its investment portfolio (the "Portfolio") in a manner consistent with the investment objectives stated herein.

1. SCOPE

This Policy applies to all assets that are included in the Foundation’s Portfolio.

2. OBJECTIVES

The Performance Objective is to maximize total return of the Portfolio net of inflation, spending and expenses, over a full market cycle (generally defined as a three to five year period) without undue exposure to risk.

3. STRATEGY

Because the Portfolio is expected to endure into perpetuity, and because inflation is a key component in its Performance Objective, the long term risk of not investing in growth securities outweighs the short term volatility risk. As a result, a significant portion of assets will be invested in equity or equity like securities, in addition to fixed income securities. Fixed income securities will be used to lower the short term volatility of the Portfolio and to provide income stability, especially during periods of weak or negative equity markets. Cash is not a strategic asset of the portfolio, but is a residual to the investment process and used to meet short term liquidity needs.

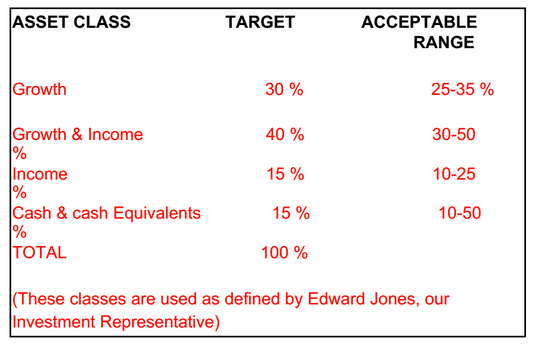

Asset Allocation:

REBALANCING

In maintaining these asset allocation acceptable ranges, the Portfolio will be reviewed no less frequently than quarterly, and rebalanced to targets as necessary. The appropriateness of this overall allocation will be reviewed annually by the Board.

4. GUIDELINES AND RESTRICTIONS

GENERAL

The Foundation’s investment advisor shall:

a. Invest only in mutual funds, as necessary to meet the allocation objectives stated herein;

b. Immediately notify the Foundation’s Investment Committee in writing of any material changes in the investment outlook, strategy, or portfolio structure;

c. Make no trade without the prior consent of the Foundation’s Investment Committee;

d. Review the Portfolio no less than quarterly to confirm adherence to the acceptable range of allocation , and provide the Investment Committee and Board with a Portfolio statement reflecting the relative current values of the Portfolio investments;

e. Anticipate distributions (as determined by the Board) no less frequently than quarterly;

f. All temporary funds administered by the Foundation shall be invested solely in a money market account and shall accrue all interest earned on such account. This will eliminate the potentially drastic effect short term market fluctuations will have on these less than permanent funds.

5. PERIODIC REVIEW AND AMENDMENTS

The Board recognizes this Investment Policy requires periodic review and, if conditions suggest, consideration of changes or inclusion of additional terms. No changes to this Investment Policy shall be effective unless approved by the Board.